Part 2: Pharma Sales Data Exposure! Increased Cardiac-related issues and Cancer!

The Pharma sales data that I exposed previously came from Singapore. The reason why I used Singapore is that it is a tightly controlled group where almost 90% of their population has been double vaccinated by the end of 2021, and by the middle of 2022, nearly 80% have been triple vaccinated [SOURCE].

In 2021 there were virtually no COVID cases in Singapore, and the number of COVID deaths was negligible, as you can see below.

I’ve mentioned I worked in Big Pharma in Singapore in the early 2000s and again in the mid-2010s. It is a Regional Hub for most Big Pharma for Asia/Australia/Japan/Middle East. They keep records well, and I don’t believe they fudged data (like ONS UK).

If you haven’t read the first part of the data exposure, please read it here:

More Smoking Gun data pointing to Increased Cancer

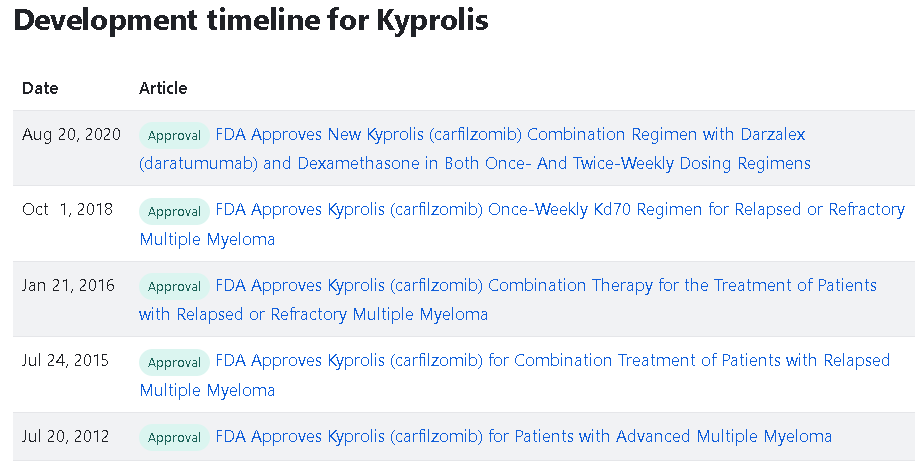

Kryprolis (Sold by AMGEN)

Kyprolis (carfilzomib) is a proteasome inhibitor indicated for treating patients with multiple myeloma.

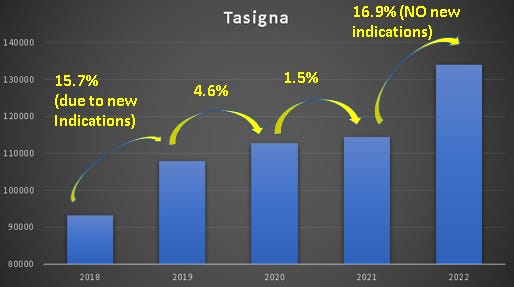

Tasigna (Sold by Norvatis)

Tasigna (nilotinib) is a kinase inhibitor indicated for treating chronic phase and accelerated phase Philadelphia chromosome-positive chronic myelogenous leukemia (CML).

As you can see, Tasigna received a new indication in 2017 and 2018, causing a bump in sales from 2018 to 2019. As I said previously, new indications would push sales.

It didn’t receive any new indications since then, and it is a relatively old, widely used drug. Usually, it grows in single digits over the years, but in 2022 it jumped 16.9%.

Zoladex (Goserelin)

Zoladex is a very old drug (approved in 1987), and Big Pharma no longer promotes it. When certain drugs are no longer promoted, some doctors continue using them because it works well and they are used to them. Big Pharma doesn’t profit much from such drugs - they are available in generics and are very cheap.

Zoladex is used in the treatment of breast and prostate cancer.

As you can see, sales of Zoladex jumped 15.3% in 2022 despite being an old, non-promoted drug.

Revlimid (Sold by Bristol Myers Squibb)

Revlimid (lenalidomide) is a prescription medicine, used to treat adults with multiple myeloma (MM) in combination with the medicine dexamethasone. I wanted to illustrate a popular drug used to treat Multiple Myeloma.

However, the trend broke in 2022 (It dropped 57%) because the patent expired in 2022 and generics came in, so we cannot find any insights from this drug. I want to illustrate some limitations of analysing drug sales, especially those out of patent protection.

While doing this analysis. We need to eliminate other factors such as patent expiries, new indications, new studies…etc.

We have identified six cancer drugs that showed “unexplained and sudden” increases in Sales after the country has been triple vaccinated. Furthermore, they come from different Big Pharma companies, so we know this is not a supply chain or a sales and marketing initiative-driven issue.

Cardiac Related Drugs

Now, let’s look at some Cardiac Related Drugs.

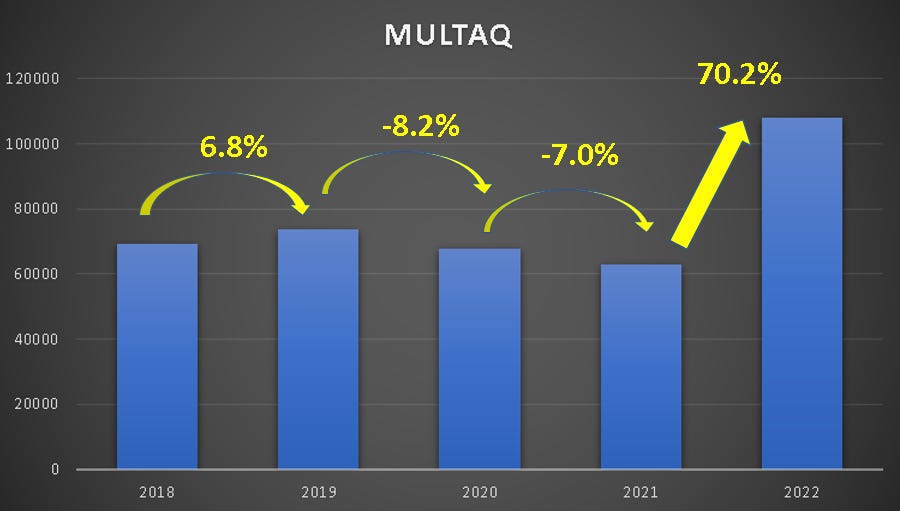

Multaq (Sold by Sanofi Aventis)

Multaq (Dronedarone) is an antiarrhythmic drug indicated to reduce the risk of cardiovascular hospitalization in patients with atrial fibrillation (AFib). Multaq is a modified version of a popular AFib drug, amiodarone. Amiodrarone’s patent is expired, and there are multiple generics versions in the market.

Antiarrhythmics (Multiple generic brands)

If we look at the whole Anti-Arhythmics drug class (excluding Multaq), the surge happened in 2021 when vaccinations started.

Note the difference between Multaq and the other antiarrhythmic. It is essential to understand the difference here. Multaq is prescribed after an AFib patient returns to normal heart rhythm, and it reduces the chances of AFib recurring.

The other antiarrhythmics (several generics) are prescribed when a patient is diagnosed with AFib. This is why you see delayed sales in Multaq vs the other antiarrhythmic drugs.

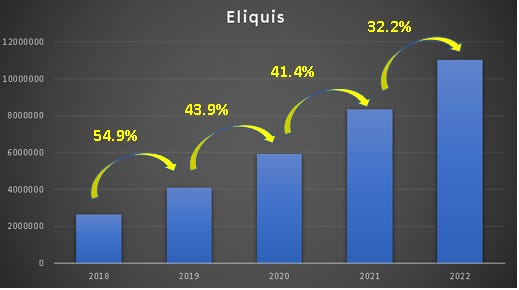

Eliquis (Sold by Pfizer)

Eliquis (apixaban) is an anti-clotting drug sold by Pfizer and Bristol Myers Squibb. I don’t see any patterns pre and post covid (and vaccinations). Drug sales have been going up in a double-digit trend since it launched in 2013. I saw some clips on the internet claiming Pfizer bought Eliquis in 2017. I don’t think that is true; Pfizer/BMS have always sold Eliquis since 2013.

Similarly, we don’t see any alarming trend for the main competitor of Eliquis, Xarelto (which is sold by Bayer).

Here are my thoughts on Anticlotting drugs. Before the new generation of anticlotting medications, doctors historically prescribed Warfarin (an ancient anticlotting drug with the same active ingredient as a rat poison). Unfortunately, Warfarin comes in many different doses, and doctors need to be extremely careful with the dosages of Warfarin because patients can easily get overdosed, and the side effects are pretty horrendous (internal bleeding and deaths).

The new anticlotting drugs came around 2012 with Eliquis, Xarelto and Pradaxa. Big Pharma claimed they were safer than Warfarin, but many doctors had patients die or have severe side effects. One of these Big Pharma with the new generation anticlotting drugs was fined 650M in 2014 [SOURCE]

I hypothesise that anti-clotting drugs increased marginally (at least looking at Singapore’s data) because doctors hesitate to prescribe medicines that will cause death. It becomes their problem if the patients die due to their prescriptions, especially when used as prophylaxis (prevention of clots). It won’t be their problem if patients die of stroke/heart attack.

Entresto (Sold by Novartis)

Entresto is a drug indicated for Heart Failure patients. It received approval for new indications in 2019 and 2021, so we see a sales leap in those years.

But in 2022, it didn’t get any new indications and experienced an even more significant sales leap (58.2%). This drug is good money for Novartis because it is approved for chronic heart failure (meaning, take for life!). Whenever you see the word “Chronic,” it means “take it for your whole life!”. I have experience with Entresto because my dad takes this drug for his heart failure, which costs almost $1,000 a month out of pocket!

Summary

Cardiac-related drugs are hard to analyse because most of the drugs have gone generic (Beta blockers, ACE inhibitors, ARBs etc.). Unfortunately, tt is challenging to get generic drug sales data. Part 3 of this article series will explain how I acquired these data. Please subscribe if you are interested to know. I will also reveal how Big Pharma uses this data to increase drug sales!

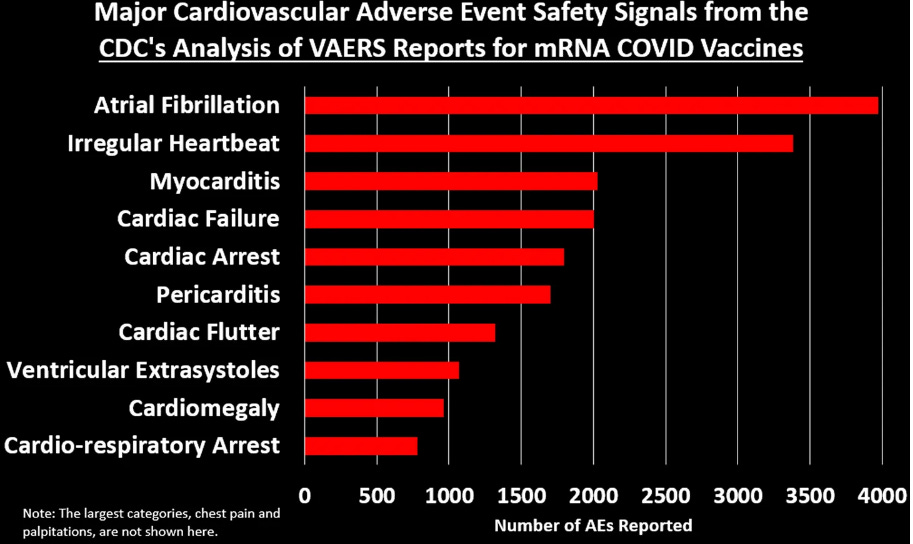

If we look at CDC’s report, we can see that AFib is the most reported cardiovascular-related adverse event post-vaccination. So it makes sense that the sales of Multaq skyrocketed in 2022. Multaq is prescribed to prevent the recurrence of AFib (meaning, these patients had AFib earlier, and now they are on Multaq. So that’s one of the reasons there is a delayed increase in sales.

You can read more about the CDC Data here, by Josh Guetzkow.

Similarly, for Cancer, there is also a “delayed” effect post-vaccination because most people get diagnosed a few months or years after the Cancer starts. After all, there are no symptoms in the beginning. We now see cancer drug sales increase one-year post-vaccination. It will be interesting to see more sales data in the coming months. If the sales data accelerates at the current pace, we will start an explosion of Cancer related deaths a few years later.

Read Part 3 here:

Signing off for now

-Aussie17

PS: As mentioned previously I’m going through some bumps in real life, so my updates might take some time in the coming days and weeks. Thanks for those who supported me with paid subscriptions!

If you enjoyed my work, please consider donating a paid subscription or buying me a one-time coffee here!

It would help if you shared my posts widely too! Thanks!!

I support the "market survey" (sales) approach you are using. Sales numbers don't lie - and I like that you included "going off patent" and "new indications" effects on sales to show us the limitations of the approach too. This adds credibility. Almost as if you've done this before (or sat through them) a hundred times in corporate presentations - or something.

Region-wide sales numbers are equivalent to doing a near-real-time survey of all the doctors in the region. Its much more powerful than the observations of a single individual.

Lastly - I vote to keep the pineapple. I like it. Its very sales-and-marketing. :)

Great work. Can’t say I’m surprised. There’s always a bigger plan at play and clearly they’ve anticipated these things.