Part 3: Pharma Drugs Sales Lifecycle

And where Pharma Sales Data comes from

In this article, let me explain why I am shocked by some of the Pharma Sales Data. If you haven’t read it, here is the link to Part 1 and Part 2, where I shared the Sales data of Oncology (cancer) and Heart Drugs. I’ve been looking at Pharma Sales Data for almost 20 years. Most of my time in Pharma was spent analysing Sales and participating in board room meetings talking about Sales numbers. I must have created thousands of drug sales-related slides.

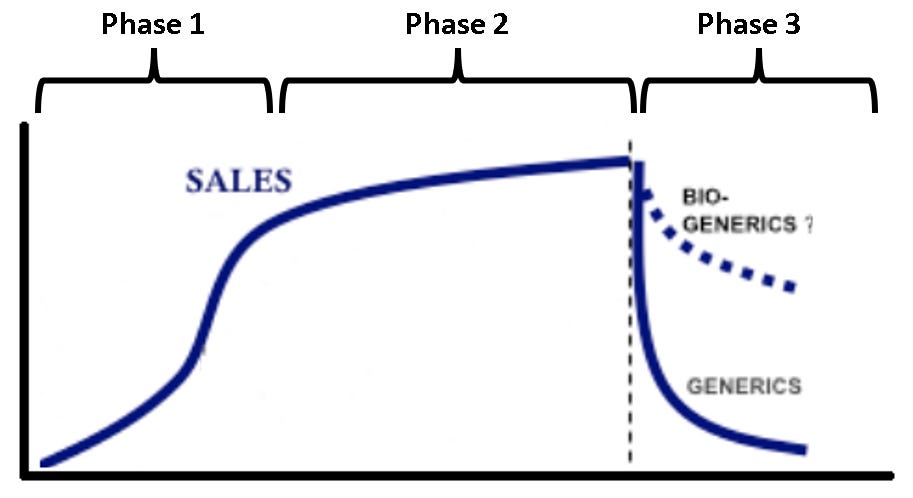

The first thing you need to understand is the Pharma Drug Sales Lifecycle. Typically a Pharma drug goes through three phases in its lifecycle.

Sales Lifecycle of a Pharma Drug

Phase 1: Drug Launch

Phase 1 is the most crucial phase to determine a drug's success. During Phase 1, the Sales look like an S-Curve. The steeper the S-Curve, the more money the drug makes during its lifecycle. During Phase 1, we spend a lot of money to ensure the S-Curve is as steep as possible. This includes:

Creating a narrative - i.e. "The Vaccine is Safe and Effective."

Enforcing the narrative - ensuring all Key Opinion Leaders, Medical Journals, Celebrities, and Politicians sing the same message. I explained this in detail in Pharmafiles #6, where we can even get President Biden to tweet a Pharma Key Message.

Sustaining the narrative - keeping an eye on dissenting scientists and doctors. If there are any dissenting voices, we have Key Opinion Leaders on standby to make sure dissenting voices are silenced. I explained what Key Opinion Leaders (KOLs) are and how we groom KOLs in Pharmafiles #3

Several times in my pharma career, we pulled a particular new drug from the market because we realized it wasn't getting enough sales traction in Phase 1, and we had to go back to the drawing board to revise the "key message".

Phase 2: Stable Sales

Phase 2 of a drug's lifecycle is usually a Brand Manager's dream job (A brand manager is someone responsible for a particular drug).

During this phase, drug sales are stable. Drug sales stay mostly the same year over year. Usually, it grows by 5-10%, according to the growth of a disease. For example, in a particular country, diabetes may be growing at a rate of population growth (i.e. if the population is growing at 3%, the drug sales will increase naturally at a rate of 5-6% even if there are minimal marketing activities). That's because patients already on the drug will constantly be on the same medication - doctors do not switch drugs for no reason if a patient's condition is controlled. This is why Phase 2 is usually a dream job for Brand Managers.

When I looked at the drug sales, I checked for Drugs that are in Phase 2. During this phase we don't expect a 50% sales jump suddenly. Of course, there are times when it happens; for example, if a competitor drug gets pulled out of the market for any reason, its market share will shift to all competing drugs. Once all causes are eliminated, the sales can only come from new patients.

Phase 3: Generics Entry

Phase 3 happens when the drug's patent expires. Generics start flooding the market, and the sales will collapse. Small molecule drug sales drop 50-80% overnight when the patent expires. In layman's terms, "small molecule drugs" are pills; they are straightforward to copy and manufacture.

Large molecule drugs (like the mRNA) don't drop that much because they are harder to replicate. So one of the reasons why Big Pharma is moving to mRNA and "large molecules" (we call large molecules "biologics". Thats when the word "Pharma" becomes "Biopharma") is because they cannot be replicated easily when the patent expires; hence the sales don't drop as much as small molecules.

Pharma Sales Data

In Pharma, there are usually two sources of Sales data. These are Ex-factory Sales and In-Market Sales. We seldom use Patient Sales data to analyze overall market dynamics because these data are highly fragmented (they come from various sources - various insurance companies, governments' public payment schemes, state governments, federal governments etc.). Secondly, they are also limited by privacy laws - these data need to be de-identified before they can be made available.

Ex-factory sales

Ex-factory sales are the numbers you see in the company’s Annual Reports. These numbers do not reflect the actual market demand accurately. For example, Pfizer’s recent Earning Reports even differentiated the mRNA’s “Doses Sold” and “Doses Used”.

The amount of vaccines they sell differs from what is used in the market. Most of what they sold in 2022 (and 2023) goes directly to the trash bin because nobody wants the vaccines anymore. However, it is still counted as sold because governments "overbought" these vaccines and they cannot return the unused vaccines.

You can see here that the vaccines administered worldwide are almost near zero in 2023, but Pfizer is still expecting sales of mRNA to triple in three years. They are simply colluding with governments to siphon tax-payers money into their pocket while the vaccines go straight into the trash bin.

In-Market Sales

The data that I acquired is In-Market Sales Data. It is a better reflection of actual market demand.

In-Market Sales Data comes from Drug Distributors. When Pfizer sells drugs, they are distributed by drug distribution companies. These companies are responsible for distributing Big Pharma drugs to hospitals and pharmacies. They distribute drugs for all pharmaceutical companies. They act as the middlemen between Big Pharma and the hospitals/pharmacies. Depending on sales volume, they take a cut from the drug sales (typically 3-7%).

Their revenue doesn't only come from the sales of drugs, but they also sell "Sales Data" to market research companies which then consolidate all the data and resell them to Big Pharma.

Big Pharma spends a lot of money to purchase these sales data because it shows them their competitor's sales. We spend millions of dollars annually to acquire these sales data so we know how our drug is doing in the market (vs competitors).

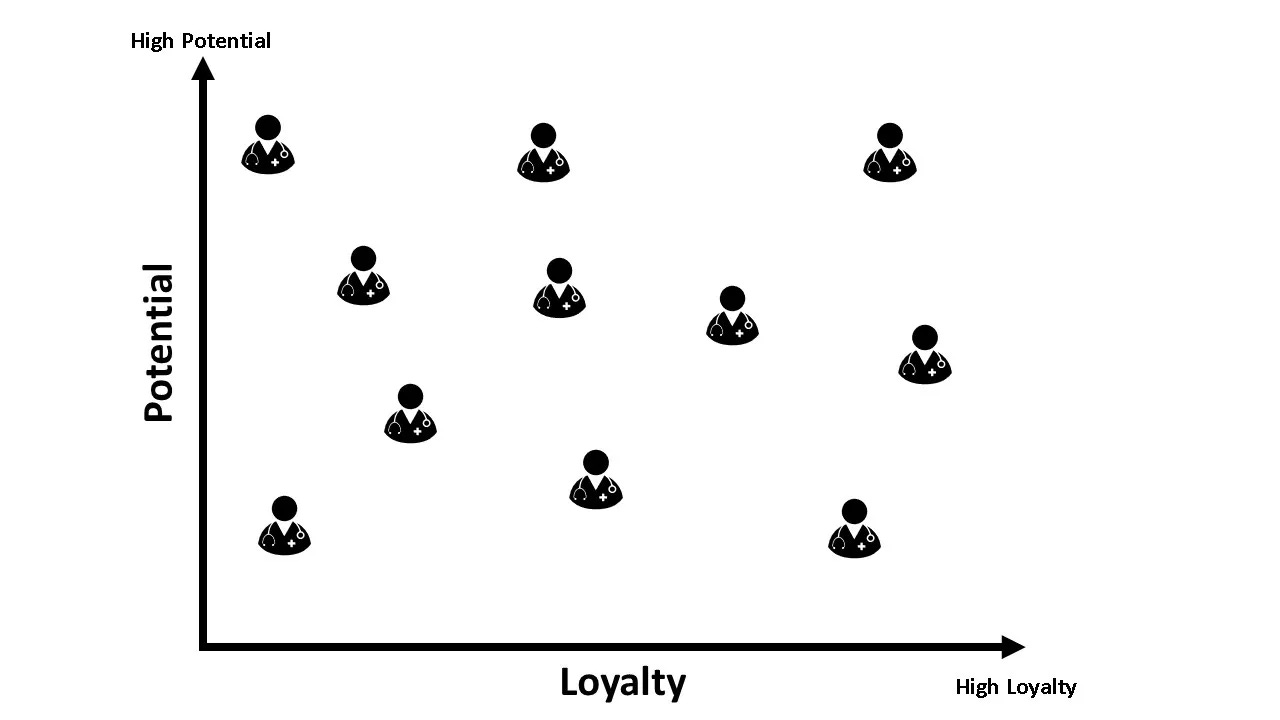

Using these sales data, we rank our customers (doctors) according to their prescription potential (read as "Sales potential") and loyalty. Once the doctors are rated accordingly, we use various techniques to influence prescription behaviours.

If you like to know more about how Big Pharma systematically influence doctors' prescription behaviour, read PharmaFiles #1 here:

Until then, Signing off for now!

-Aussie17

Great post! Thanks for shedding light on this. The way pharma sales and marketing is set up it is more important that they can sell the drug to you than that it’s actually safe and effective. In other words, as long as they can sell you on the idea that the drug is safe it doesn’t matter if it really is. Scary but true. Literally all about profits.

Late Stage Capitalism. Fascinating to compare to the economics of le ancien regime, France pre Revolution(s). A systemic, deliberately designed outright enslavement of human endeavour. The SYSTEM is designed that way. The more Control, the better The System is working. Can the phoenix rise from nuclear fire? Push the button (Chemical Bros).